- Psbank Time Deposit

- Metrobank Time Deposit Interest

- Metrobank Time Deposit Per Annum

- Metrobank Time Deposit Calculator

The time deposit td interest rate is a for a deposit of 50,000 to 199,999 Peso and applies for a term between 181 - 364 days for the amount 20MM & Higher The rate of 1.125% is 0.38% lower than the average 1.5%. Also it is 0.625% lower than the highest rate 1.75 Updated Jun, 2018 on Metrobank's secure website. A time deposit is a type of investment wherein the deposit is locked in for a set amount of time. Compared to a savings account, time deposits have relatively higher interest rates and are considered virtually risk-free investments, as amounts of up to P500,000 are insured by the Philippine Deposit Insurance Corporation (PDIC). A Metrobank Time Deposit allows you to grow your money while being able to access it easily. Know more about the benefits of a time deposit for your business. This app works best with JavaScript enabled.

Time deposits are safe

If you are looking for an investment but afraid of the risk of losing money, then time deposit is just the right investment for you.

Catch me in my live training events! (quick plug)

The heart of why I do this seminars is I want to build a generation of Filipinos with the right foundation in stock investing. I want to bring smart investing to every Filipino around the world! If you would like to know more on how you could time the market checkout the trainings below.

ICON 2018 — May 26, 2018

Stock Smarts Melbourne – June 9 – 11, 2018

Stock Smarts Manila — June 16, 17, 23, 24 & 30 2018

Stock Smarts Hong Kong — July 28, 2018

Stock Smarts Iloilo — August 10 – 12, 2018

What is a time deposit?

A time deposit is an interest-bearing form of bank deposit that has a specified time of maturity. It requires the customers to deposit a certain amount of money in a bank and wait for it to mature or earn interest without any withdrawals. Interest earnings are determined quarterly, monthly, or annually. Although the amount you deposited will be inaccessible until the end of your time deposit (withdrawing the amount before a specified period of time will incur certain penalties), you will still have regular cash-flow in the form of interest payments.

Leading banks

In the Philippines, there are a number of banks to consider if you want to make a time deposit. Although, for all banks it is common that your earnings are higher if you invest a higher amount for a longer period time, there are banks with relatively higher time deposit rates than others. Below is a list of the best banks to include in your bowl of choices if you ever think of putting your excess money in time deposit.

1 year (12 months) Time Deposit of Php100,000 (as of March 29, 2018)

Security Bank Peso Time Deposit

- Interest rate: 2.01%

- Investment returns: Php1,608

- Estimated payout: Php101,608

EastWest Peso Time Deposit

- Interest rate: 1.75%

- Investment returns: Php1,400

- Estimated payout: Php101,400

PBCOM Regular Time Deposit

- Interest rate: 1.50%

- Investment returns: Php1,200

- Estimated payout: Php101,200

RCBC Regular Time Deposit

- Interest rate: 1.38%

- Investment returns: Php1,100

- Estimated payout: Php101,100

Maybank Classic Time Deposit

Psbank Time Deposit

- Interest rate: 1.25%

- Investment returns: Php1,000

- Estimated payout: Php101,000

6. Security Bank Peso Time Deposit

- Interest rate: 1.20%

- Investment returns: Php960

- Estimated payout: Php100,960

7. Chinabank Diamond Savings

- Interest rate: 1.00%

- Investment returns: Php800

- Estimated payout: Php100,800

8. UnionBank Peso Time Deposit

- Interest rate: 0.88%

- Investment returns: Php700

- Estimated payout: Php100,700

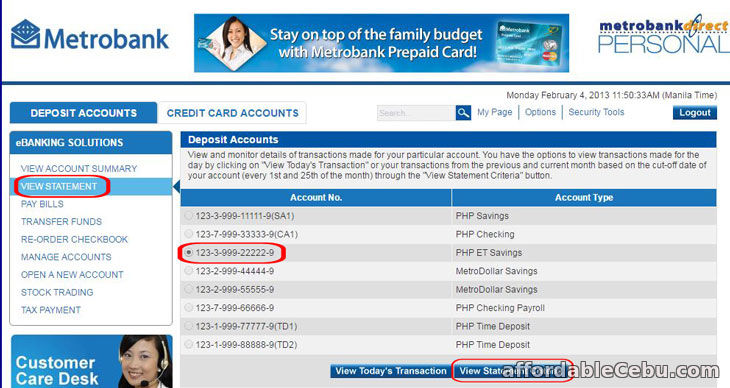

9. Metrobank Peso Regular Time Deposit

- Interest rate: 0.88%

- Investment returns: Php704

- Estimated payout: Php100,704

10.CTBC Peso Time Deposit

- Interest rate: 0.85%

- Investment returns: Php680

- Estimated payout: Php100,680

These are only the best choices depending on the interest rates. If you have other factors to consider, such as the proximity and accessibility of the bank to your home/workplace, then your options may vary. Furthermore, some banks sometimes offer promotions including a surge of their time deposit interest rates. You may also want to watch out for these. Of course if you want growth the stock market is still the best place where you can make your money grow over the long term.

Metrobank Time Deposit Interest

New book and other books on Investing, Business and Finance.

Metrobank Time Deposit Per Annum